Ct600 Software

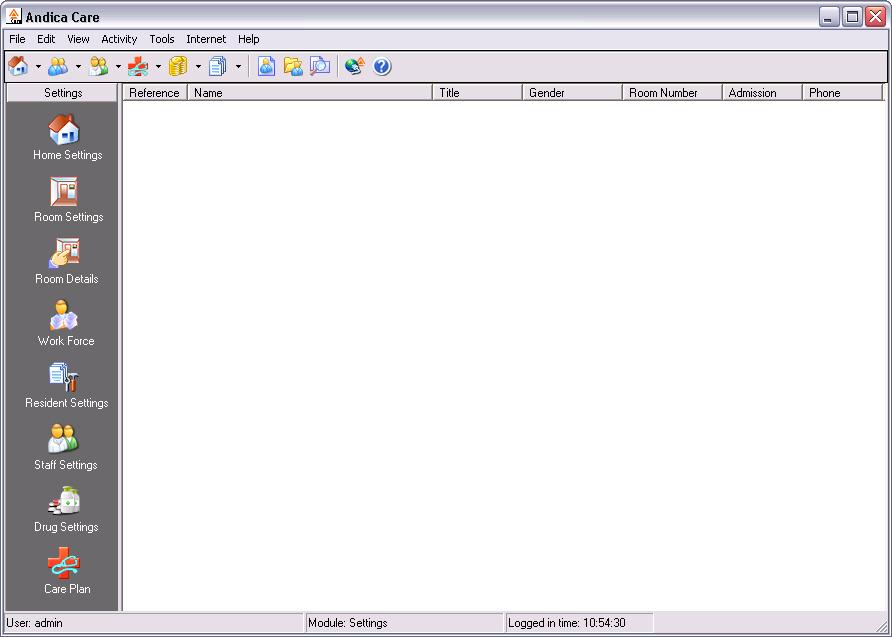

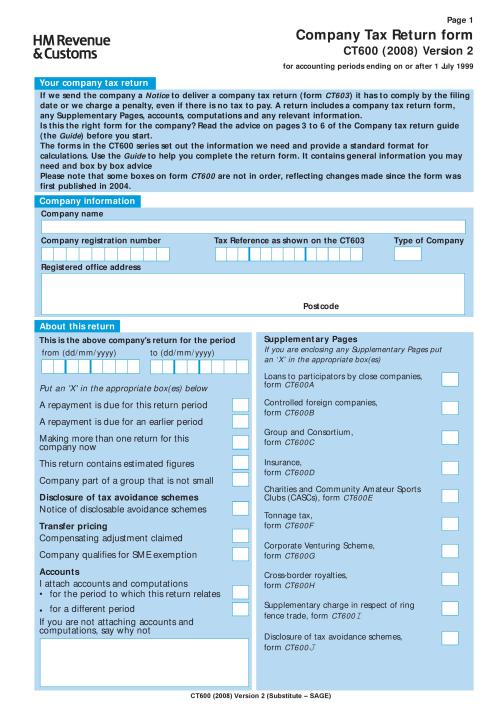

Company Tax Return CT600 for Corporation Tax supplementary pages CT600A, CT600E and CT600J. Electronic filing of HMRC CT600 returns for UK Tax Professionals. HMRCs has retired its free CT600 software, so what alternatives do accountants have enspenspSuccess Filing CT600 from FreeAgent. If you dont use the calculator then you do indeed need some kind of final accounts software and then some iXBRL tagging. New company tax return form CT600 issued. HMRC says commercial software developers are aware of these changes and are updating their online filing products. Farewell CT6. 00. What are the alternatives HMRCs form based CT6. The free software, used for filing CT returns, will remain available to accountants until 3. December 2. 01. 6. It is being replaced by HMRCs new online service known as CATO Company Accounts and Tax Online. Cd Exaltasamba Luz Do Desejo more. However, this time around CATO wont be available for accountants. It is meant to be used directly by businesses through their own filing credentials. Thankfully, the introduction of CATO wont affect small and medium sized practices who have software from a chosen provider. IRIS/ODL/Business_Tax/BT_1.jpg' alt='Freeware Software Download Full Version' title='Freeware Software Download Full Version' />However, for thousands of accountants, that dont own CT software, the challenge is to find an alternative solution. But before we dive into the list of sotware options, let us look at the selection factors. What to consider Every accountant will have a different requirement some might have more returns to file while some will have fewer. When choosing a software consider the following 1. Software functionality. First things first, check if CT filing functionality is available on the accountancy software you currently use. It could easily be something you forgot to notice. In case your software doesnt have the functionality, review your current systems, and find out if you should bring other separate functions such as accounts, company administration and practice management under one umbrella software, which includes an integrated CT6. Price. HMRCs system was free to use, so its inevitable that you will have to incur new software costs. Consider the pricing model when looking. Find out what payment options are available an annual subscription could be more beneficial if you have many returns to complete for example. But if you have a relatively low number of returns, then the Pay as you go model might be more cost effective. Find out whats included in the price. Technology desktop or cloud basedWith digital technology revolutionising how we work, you should definitely consider the underlying technology. Would you prefer to file CT returns on your desktop, or do you want it available on the cloud for youyour clients to access it on the internet Both have their virtues, however, a cloud based solution, in our option, is more suitable. Experience support Numerous CT filing software are available in the market. Therefore, look for the solution providers experience and track record in offering a CT solution. Find out things like how frequently their software is updated or how many accountants are already using it. With regards to support, find out What are the support hours Is support free or chargeable Is training and online support also provided Software options. There are quite a few sophisticated options on the market. The following recommendations were made by accountants on various Accounting. Web threads How can QXAS help The introduction of CATO means you can either invest in new software or outsource the CT6. QXAS is proficient in the use of IRIS, Tax. Ct600 Software' title='Ct600 Software' />Best Free Software Download Sites

Software options. There are quite a few sophisticated options on the market. The following recommendations were made by accountants on various Accounting. Web threads How can QXAS help The introduction of CATO means you can either invest in new software or outsource the CT6. QXAS is proficient in the use of IRIS, Tax. Ct600 Software' title='Ct600 Software' />Best Free Software Download Sites The iXBRL Accounts, produced by any HMRC recognised iXBRL Accounts generating software, may be attached to the CT600 along the Ftax iXBRL Computations. The Governments free corporation tax software for filing CT600s will no longer be available for clients tax returns for periods ending on or after 1st January. Guidance intended to help HM Revenue and Customs HMRC software developers and substitute form producers to create their products. Filing your Company Tax Return online a beginners guide. This guide contains information to help you submit your Company Tax Return form CT600. Comprobar Drivers De Mi Pc. Calc, Sage, CCH, Capium, Digita, CT Pro, and any other software of your choice. Weve filed thousands of corporate tax returns on behalf of accountants since 2. HMRCs free software did and more. Talk to Parth on 0.

The iXBRL Accounts, produced by any HMRC recognised iXBRL Accounts generating software, may be attached to the CT600 along the Ftax iXBRL Computations. The Governments free corporation tax software for filing CT600s will no longer be available for clients tax returns for periods ending on or after 1st January. Guidance intended to help HM Revenue and Customs HMRC software developers and substitute form producers to create their products. Filing your Company Tax Return online a beginners guide. This guide contains information to help you submit your Company Tax Return form CT600. Comprobar Drivers De Mi Pc. Calc, Sage, CCH, Capium, Digita, CT Pro, and any other software of your choice. Weve filed thousands of corporate tax returns on behalf of accountants since 2. HMRCs free software did and more. Talk to Parth on 0.